has capital gains tax increase in 2021

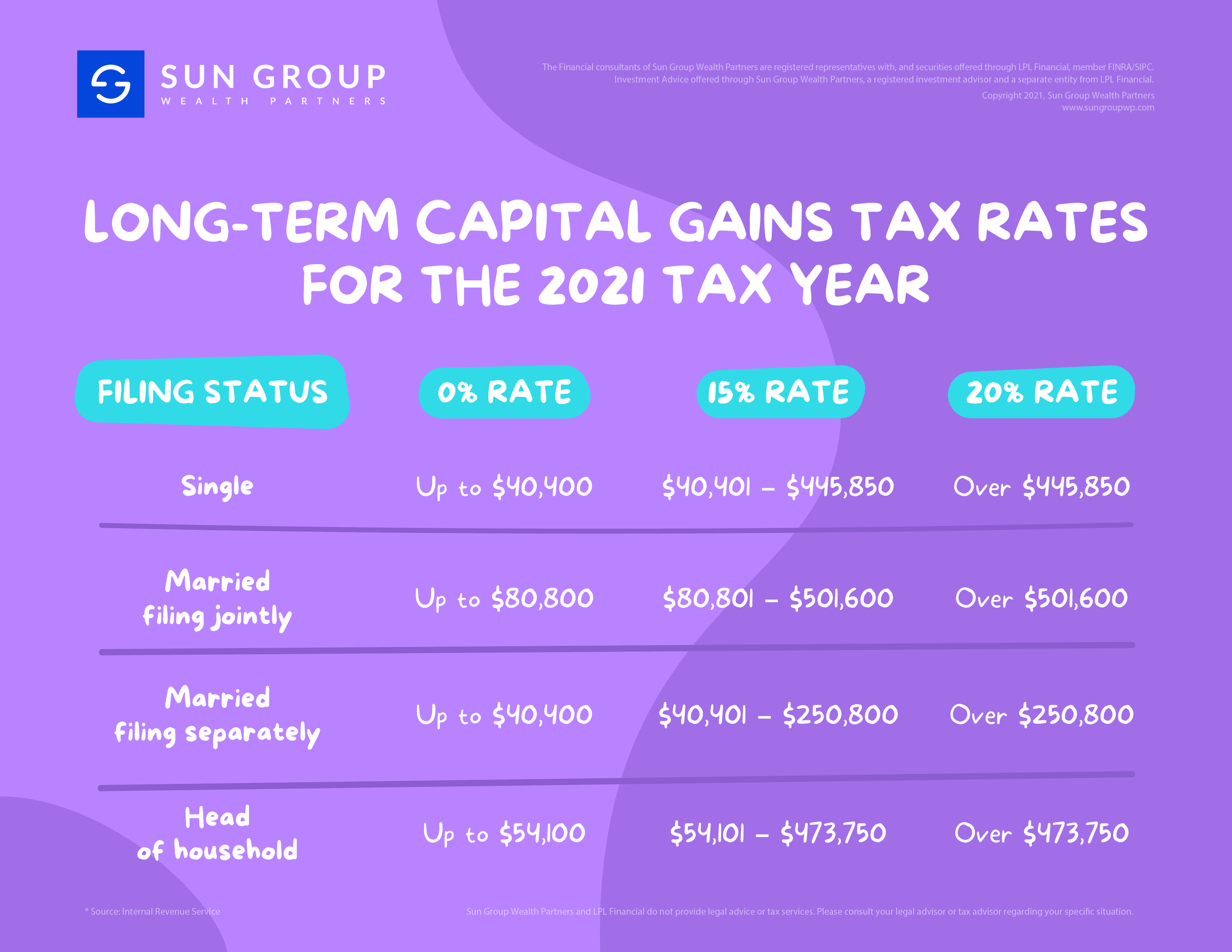

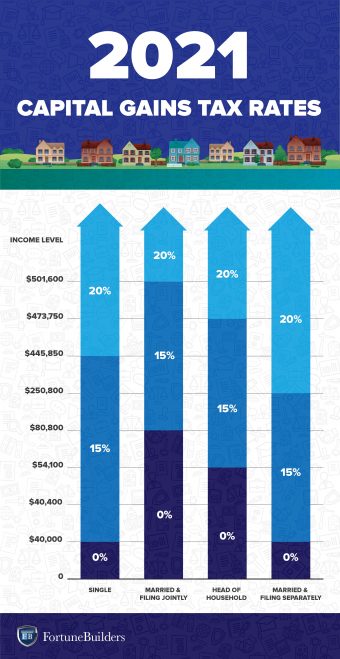

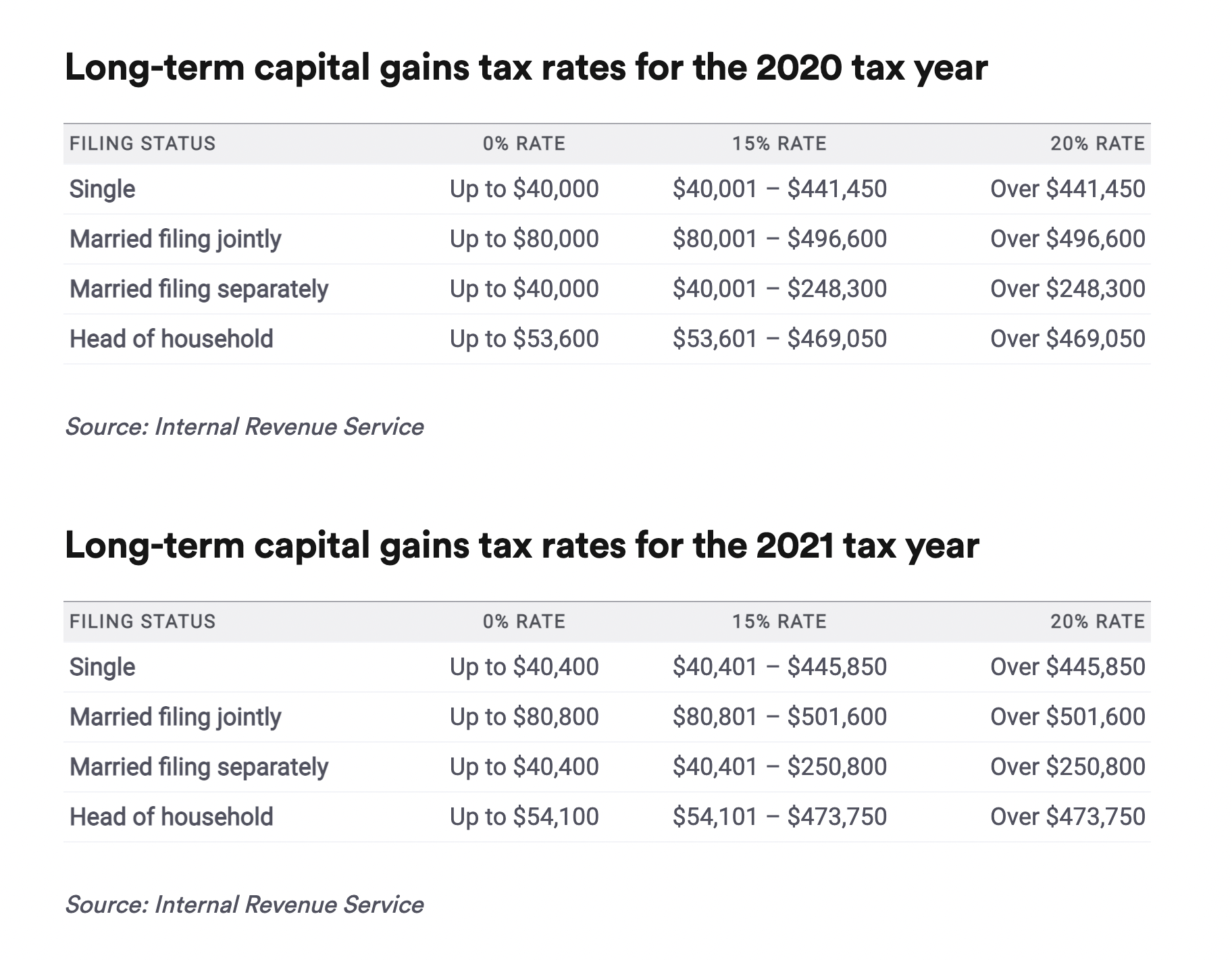

In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes. The chart below illustrates how the change in capital gains tax rates affects the sellers net proceeds.

What Are The Capital Gains Tax Rates For 2022 Vs 2021 Avitas Capital

Based on filing status and taxable income long-term capital gains.

. To address wealth inequality and to improve functioning of our tax. The 238 rate may go to 434 for some. Many speculate that he will increase the rates of capital.

Hundred dollar bills with the words Tax Hikes getty. If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or 20 rate. Filers paid hundreds of billions more in taxes for 2021 and surging capital gains may have been to blame according to an analysis from the Penn Wharton Budget Model.

For married joint filers with taxable income of. States have an additional capital gains tax rate between 29 and 133. History is a good indicator of the impact of a capital gains increase on.

Instead of a 20 maximum tax rate long-term gains from the sale of collectibles can be hit with a capital gains tax as high. Implications for business owners. With average state taxes and a 38 federal surtax the.

Unlike the long-term capital gains tax rate there is no 0. Its time to increase taxes on capital gains. Special cases for taxation.

But the Biden administration has proposed an increase to a top rate of 396 on long-term capital gains and qualified dividends for those with over 1 million in income. Tax Changes and Key Amounts for the 2022 Tax Year. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Here are the 2022 and 2021 capital gains rates. This included the increase of GT rates so they were more similar to income tax which was a big problem for anyone looking to sell. Those tax rates for long.

2022 long-term capital gains tax brackets. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. 1 week ago 2021 capital gains tax calculator.

The Chancellor will announce the next Budget on 3 March 2021. Posted on January 7 2021 by Michael Smart. 10 is levied on the total gains on capital if.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. For single filers with taxable income of.

Taxes and Asset Types - Investopedia 1 week ago Dec 21 2021 Capital gain is an increase in the value of a capital asset investment or real estate that gives it a higher worth. 2021 capital gains tax calculator. 2022 capital gains tax.

Capital Gains Tax Rates 2021 To 2022. In general the tax applicable on long term capital gains is 20 surcharge cess as applicable. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

That rate hike amounts to a staggering 82. Oct 05 2015 What Form 8949 does. 2022 capital gains tax rates.

Gassman said an increase of the top tax rates. Forms and Instructions PDF IRS tax forms Preview 6 hours ago 26 rows Instructions for Form 1040 or Form 1040. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends.

Capital Gains Tax Hmrc with Ingredients and Nutrition Info cooking tips and meal ideas from top chefs around the world. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. Weve got all the 2021 and 2022 capital gains.

Here are 10 things to know.

Long Term Capital Gains Tax Rates For The 2021 Tax Year Sun Group Wealth Partners

How Are Capital Gains Taxed Tax Policy Center

Capital Gains Tax In The United States Wikipedia

Capital Gains Taxes And The Impact On The Sale Of Privately Held Companies

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

A Capital Gains Tax Hike Should Alter Your Income And Selling Strategy

Biden Capital Gains Tax Rate Would Be Highest For Many In A Century

Real Estate Capital Gains Tax Rates In 2021 2022

The High Burden Of State And Federal Capital Gains Tax Rates Tax Foundation

Effects Of Changing Tax Policy On Commercial Real Estate

Crypto Tax 2021 A Complete Us Guide Coindesk

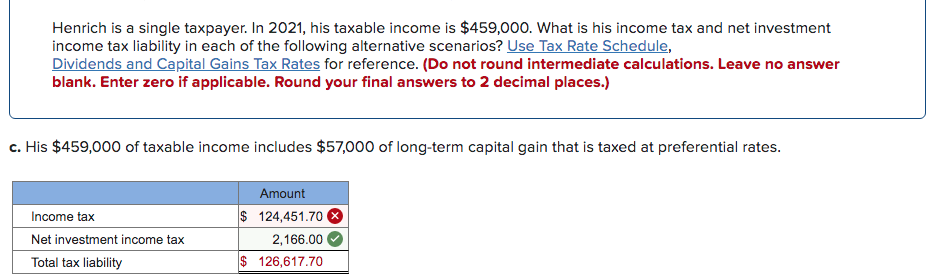

Solved Henrich Is A Single Taxpayer In 2021 His Taxable Chegg Com

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos